Educating health care professionals for the future

Promising health care careers start with a commitment to scientific excellence and a compassionate approach to patient care. That’s precisely what our students discover and learn at WesternU.

$ 90 k

Raised in emergency support funds for students

6

Pathways to the top 10 jobs in the U.S., as ranked by U.S. News and World Report

WesternU Virtual Tours

WesternU Excellence in Health Sciences Education

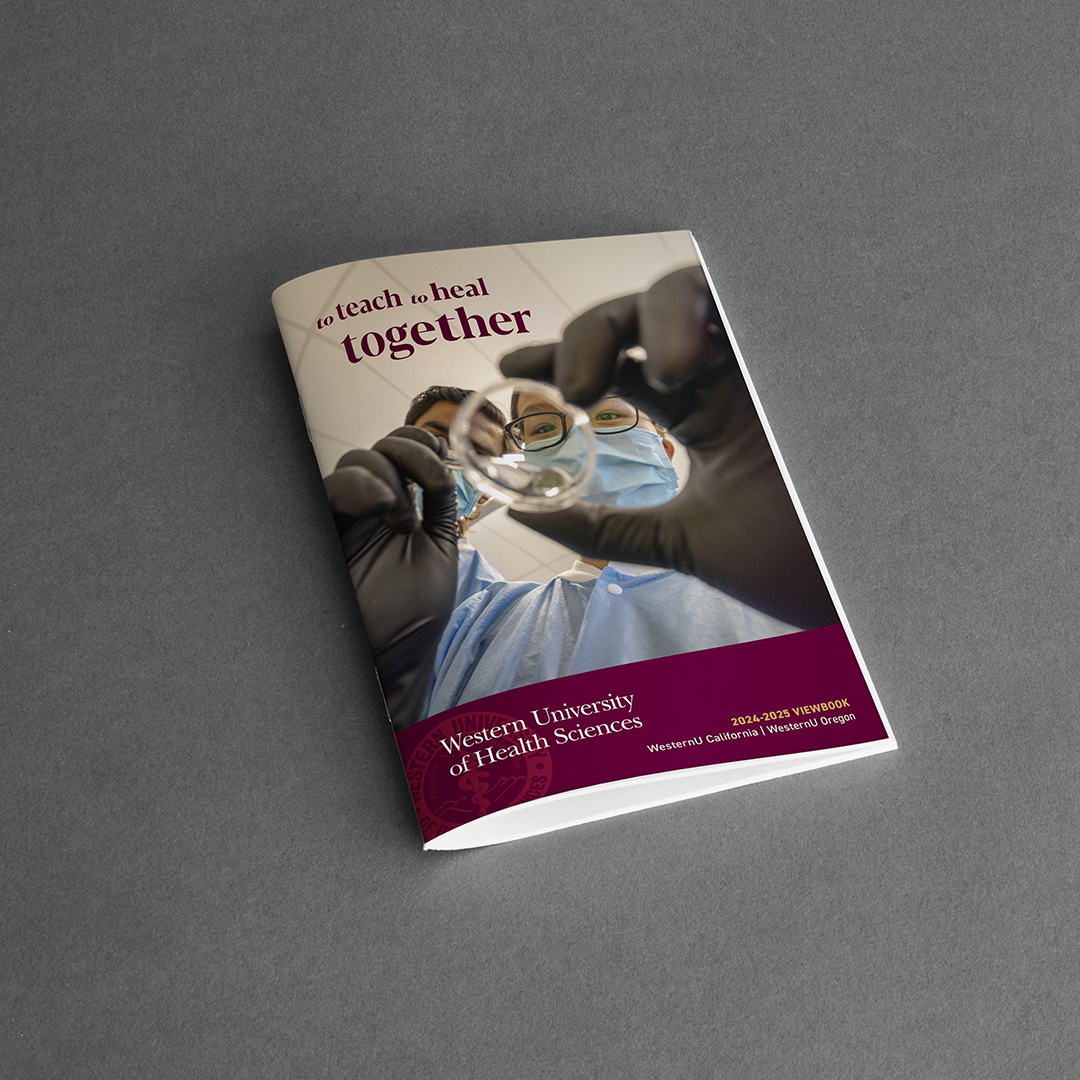

To Teach, To Heal, Together.

Our Campuses Two Homes for Health Sciences

Biomedical Research Engage in Scientific Discovery while Earning Your Degree

We’re Part of a Community that Cares

WesternU Health

WesternU Health

WesternU Health Oliver Station

WesternU Health Oliver Station

WesternU Pet Care

WesternU Pet Care

Community Opportunities

Community Opportunities

You Are Welcome Here!

You Are Welcome Here!

Humanism Our Unique Approach

Upcoming Events

All Events